Europe’s Grid – The Capital Gap in the Transition

Authors: Martin Sacchi, Xixi Jiang

Europe’s grid debate has entered a new phase. What was once a political dispute over “who pays” for network expansion is now a central element of the European Commission’s Action Plan for Affordable Energy, presented in February 2025. The Plan reflects a recognition that Europe’s decarbonised and digital economy depends on robust transmission and distribution systems, and that the public sector cannot shoulder the investment burden alone. According to EU’s guidance on anticipatory investments for developing forward looking electricity network published in June 2025, outlines the necessary investments to modernize and expand EU electricity grids by 2040, totalling over €1.2 trillion, to support the transition to a net-zero economy.

Investment scale and gap

The financial requirements are substantial. The European Commission estimates that €477 billion will be needed for transmission networks and €730 billion for distribution networks by 2040 in order to accommodate rising electrification and renewable integration. The European Investment Bank has projected that annual grid spending in Europe will reach USD 70 billion by 2025, roughly double the level of a decade ago.

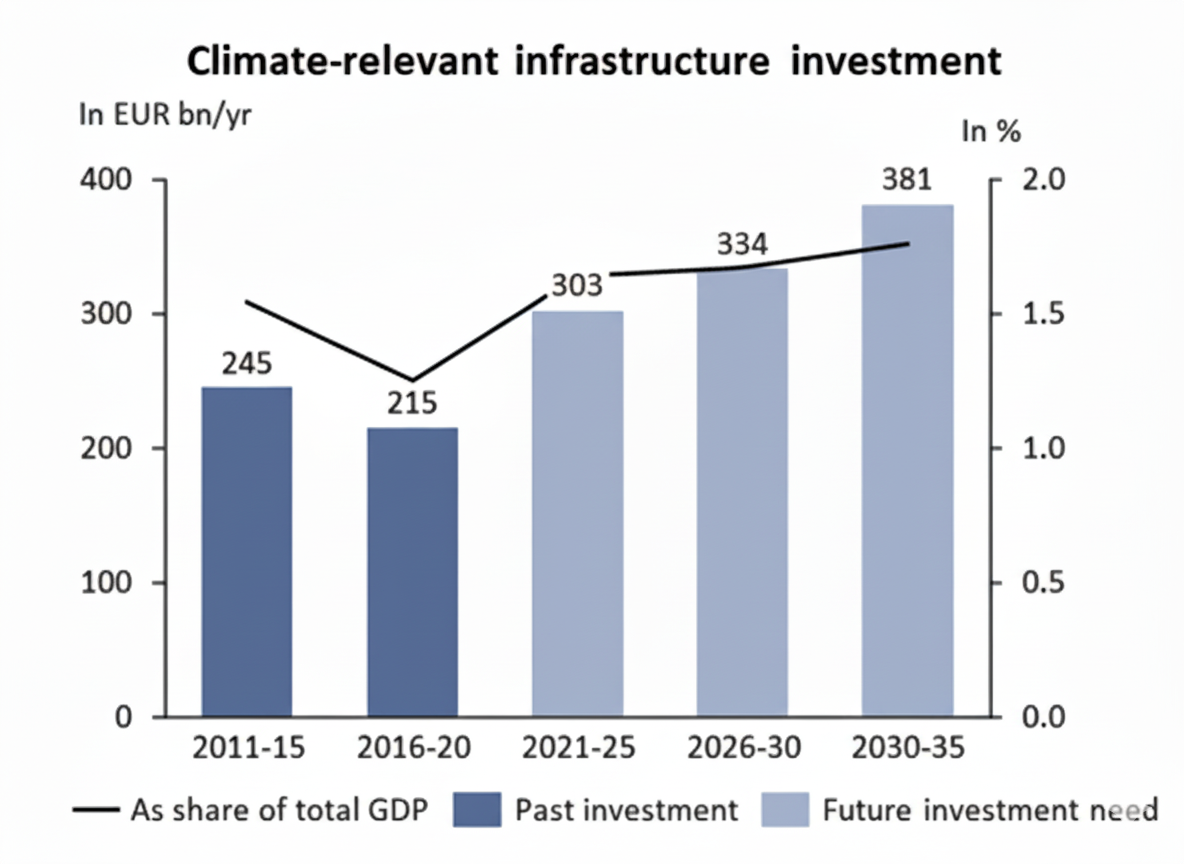

Despite this, actual investment continues to lag behind what the transition demands. The European Parliamentary Research Service has stressed that grid modernisation and expansion are central to achieving decarbonisation targets, yet Member States are not mobilising sufficient capital nor accelerating permitting processes. A recent climate-infrastructure study shows that Europe would need to raise annual climate-related infrastructure investment by nearly €90 billion above 2016–2020 levels to meet its 2021–2025 trajectory. The need is unambiguous, but capital deployment is constrained by both structural and operational barriers.

Chart 1: Climate-relevant infrastructure investment (past vs future)

Value chain challenges and opportunities

Investments in transmission and distribution system operators (TSOs and DSOs) address only part of the challenge. Performance, resilience, flexibility and digitalisation require capital deployment across the wider value chain: advanced power electronics, inverters, high-voltage and medium-voltage cabling, substations, SCADA and control systems, cybersecurity, sensors, digital twins, storage, microgrids and demand aggregation platforms.

Inverters illustrate the point. As renewable assets, storage facilities and electrolysers connect to the grid, high-efficiency, grid-forming inverters are essential to stabilise operations. These must support two-way flows, provide synthetic inertia, ride through faults, and regulate voltage. Investment is therefore required not only in deployment but also in R&D, scaling production and standardisation.

Cabling is another pressure point. With generation sites such as offshore wind farms located far from consumption centres, high-capacity HVDC and AC lines are needed, using low-loss technologies and modular installation methods to reduce costs and permitting delays.

Digitalisation is equally critical. The transition demands real-time visibility, predictive analytics, advanced maintenance, accurate load forecasting and congestion management. Distribution networks must evolve into active systems able to manage distributed generation, local flexibility markets and peer-to-peer exchanges. This requires major investment in data infrastructure, fibre and wireless communication, and digital security.

The most attractive risk-adjusted returns for private capital are often found in these fast-growing niches: grid software platforms, analytics, power electronics providers, IoT and edge solutions, and flexibility aggregators.

Chart 2: Europe’s Power Transition Bottleneck — Demand vs Grid Investment vs Infrastructure Aging

Regulatory and permitting bottlenecks

The Affordable Energy Plan recognises the drag created by permitting and regulatory inertia. It commits the Commission to propose a Grid Package in 2026, simplifying the TEN-E Regulation, increasing transparency on supply chains, and embedding digitalisation and innovation.

The Plan also requires Member States to introduce binding maximum timelines for grid and renewables permitting by mid-2025, aiming to reduce current connection delays that can extend for years. Industry associations such as EASE have called for fast-tracking of storage and grid permits, while Eurelectric has argued that the Plan should strengthen structural measures to enhance predictability.

The issue, however, is not only speed but also coordination. Cross-border projects cut across multiple jurisdictions and require environmental clearance, land rights and stakeholder engagement. Legislative deadlines must therefore be matched with oversight and enforcement to prevent further delays.

Security of supply and resilience

As Europe’s energy system becomes almost entirely electricity-based, across industry, heating and transport, the grid assumes the status of a strategic asset. Weather volatility, cyber threats and extreme events demand new levels of resilience.

The 2025 Iberian blackout which was caused by excessive voltage underlined the stakes. Portugal responded with a €137 million programme of grid upgrades, expanding grid-forming battery capacity from tens of megawatts to several hundred. Events like these demonstrate that electricity infrastructure is now a pillar of national security, not just industrial policy.

Building resilience means investment in redundancy, multiple transmission paths, fast blackstart capability, local storage, microgrids, grid-forming inverters, robust cybersecurity and real-time operational intelligence. Backup dispatchable resources may remain relevant, but networks themselves must be engineered to withstand shocks.

The Affordable Energy Plan explicitly links affordability to security as modern interconnected grids reduce bottlenecks, isolate faults, enable flexibility, and cut dependence on imported fossil fuels.

Data centres, electrification and demand pressure

Rising electricity demand adds urgency. Data centres, cloud infrastructure, AI computing, electrified industry and EV charging are major drivers. In 2025, private capital firms are targeting €17 billion in European data centre deals, underscoring their power intensity and grid dependence.

These facilities are constrained by latency, connectivity and cooling but often require several hundred megawatts per site. Grid capacity is therefore a decisive factor in location, and developers frequently co-finance upgrades or negotiate reinforcement agreements with operators.

On the industrial side, the electrification of heavy industry, hydrogen electrolysers, large-scale charging and heat pumps will multiply loads. Distribution networks must evolve from passive systems to intelligent, bi-directional grids, with smart charging, demand response and flexibility integrated into planning. Grid reinforcement and load development must be co-optimised, with shared investment models built in from the start.

Illustrative project examples

Germany’s Amprion has raised its five-year capex plan by 25 per cent to €27.5 billion through 2028, accelerating north-south transmission corridors, with one corridor (Ultranet) brought forward to begin operations by 2027. In the United Kingdom, the National Wealth Fund has extended a £600 million loan to ScottishPower to accelerate upgrades, including major Scotland-England transmission links. These examples highlight that the economic cost of delaying grid projects is now greater than the financing cost of rapid deployment.

Investment models, risk allocation and investor appetite

Private capital is increasingly receptive to regulated infrastructure assets with stable revenues, but the grid sector carries distinctive risks. Returns are long-term and moderate, dependent on tariff regulation, cost recovery and political stability.

Key enablers include predictable regulatory frameworks, transparent procurement, co-investment with public institutions, credit enhancement, project bundling, venture funding for new grid technologies, and incentives for flexibility and storage.

A Reuters analysis noted that Europe must accelerate investment to meet investor appetite. The Affordable Energy Plan seeks to de-risk grid modernisation through regulatory certainty, structural reform and faster permitting.

Sources:

https://energy.ec.europa.eu/publications/commission-notice-guidance-anticipatory-investments-developing-forward-looking-electricity-networks_en

https://www.eib.org/en/stories/electricity-grids-investment

https://www.europarl.europa.eu/RegData/etudes/BRIE/2025/772854/EPRS_BRI%282025%29772854_EN.pdf

https://www.reuters.com/business/energy/what-is-eus-affordable-energy-action-plan-2025-02-26

https://ease-storage.eu/news/statement-on-clean-industrial-deal-and-affordable-energy-action-plan

https://www.ft.com/content/48a39d2c-f5ac-470e-b2ac-93cdc5eb4be7

Chart 1: ETH Zurich energy blog, based on a meta-analysis (Klaassen & Steffen 2023 as underlying data), 2023

Chart 2: ENTSO-E, Scenario Outlook & Adequacy Forecast 2040 - December 2024; European Commission, Guidance on Anticipatory Investments for Developing Forward-Looking Electricity Networks - June 2025; European Investment Bank, Electricity Grids Investment Outlook - May 2025; European Court of Auditors, Making the EU Electricity Grid Fit for Net Zero (Review 01/2025) + GEODE, Grids for Speed - April 2025 / June 2024