China’s Energy Transition and Rising Industrial Output

Authors: Martin Sacchi, Xixi Jiang

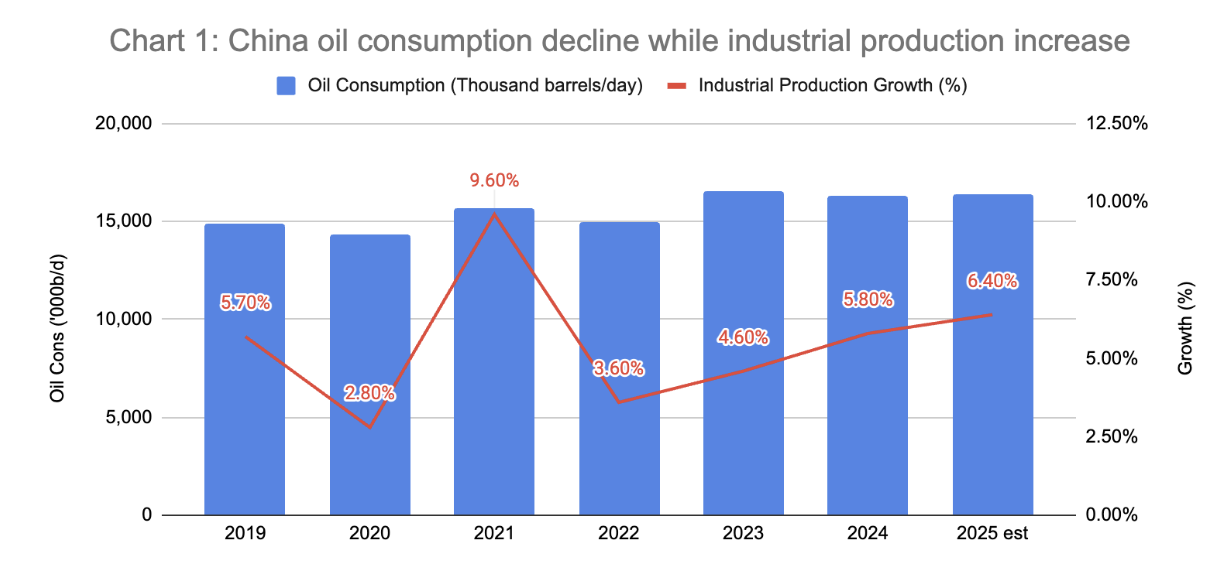

China’s oil consumption has declined while industrial production is estimated to continue to increase. Why is that?

China’s latest pledge to expand wind and solar capacity reflects a broader shift across emerging markets, where renewables have become a leading investment theme. In 2024, China has invested more than US$625bn(1) in clean energy which is 4.4% of its GDP per capita vs 2.9% for the rest of the world into EV and related infrastructure, solar, clean energy infrastructure and storage and other low emissions energy sources like nuclear. This figure is more than one third of global investment into renewable energy, meeting its solar and wind deployment target of 2030, 6 years ahead of its objective. With China’s growth in the clean energy supply chain, the deployment of clean energy is spreading to Southeast Asia, Latin America and Africa as demand for affordable technology rises.

For investors the message is clear: Clean energy is becoming mainstream as solar and wind are among the cheapest new power sources, helped by solar module costs falling more than 80% since 2010. BloombergNEF projects renewables will provide almost two-thirds of global electricity by 2040(2), with emerging markets moving faster as they build grids around renewables rather than retrofitting coal or gas systems.

Capital is following. Green bond issuance in emerging markets exceeded USD120 billion in 2024(3), led by China, Brazil and India. Multilateral lenders, such as the Asian Infrastructure Investment Bank and the Inter-American Development Bank, are lowering risk through blended finance. Funds and private equity are backing solar in Vietnam, wind in Colombia and battery storage in South Africa. The opportunity, however, extends beyond generation to minerals, processing and full supply chains, where China already commands the advantage.

Despite resources being globally dispersed, China has centralised value capture in refining, processing and downstream manufacturing. It dominates refining of rare earths, lithium, graphite, silicon and nickel; holds more than 70% of manufacturing capacity in most clean-tech sectors (apart from hydrogen electrolysers); and has retaken the top spot in global battery supply-chain rankings. While Latin America, Africa and Southeast Asia supply raw minerals, China secures the downstream margin by building processing plants, striking off-take deals and co-financing facilities abroad. This concentration delivers economic returns and geopolitical leverage, and raw resources alone no longer guarantee strategic autonomy for others.

China’s push now spans the full clean-energy stack. Its long-standing expansion in Southeast Asia has widened to nuclear, grid infrastructure and hydrogen, alongside export of integrated industrial solutions. It is exporting reactor technology, building plants overseas and delivering grid packages, from HVDC to smart systems with storage, often bundled with renewable investments. Firms are investing from batteries and advanced materials to electrochemical systems, aiming to control as many points of the value chain as possible.

In September 2025 President Xi announced China’s first absolute emissions cut of 7–10% from peak by 2035, alongside a six-fold increase in wind and solar from 2020 levels and a rise in non-fossil fuels to over 30% of energy use. Previously focused on intensity targets, this shift drew mixed reactions but underscored China’s intent. China and the EU also reaffirmed climate cooperation ahead of COP30, committing to updated 2035 targets, carbon-market collaboration, methane reduction and low-carbon technology, declaring green the defining colour of their cooperation. The signal is that China is championing the Paris Agreement and aims to be both, climate and industrial leader.

Europe, meanwhile, is reducing external dependence and diversifying its mineral supply through the 2024 Critical Raw Materials Act, which secures resilience from mining.. In March 2025 the Commission approved 47 strategic projects within the EU and in June extended recognition to 13 projects in countries such as Brazil, Canada, South Africa and Zambia, heavily focused on battery minerals and rare earths. These complement internal capacity, diversify supply and lessen single-supplier risk, creating openings for investment in mining, refining and recycling supported by EU frameworks, joint ventures and blended finance.

Given China’s scale, attractive entry points are selective. Under-penetrated geographies in Africa, Latin America and Southeast Asia welcome trusted partnerships aligned with frameworks such as the Critical Raw Material Act (CRMA). Niche specialisms in high-purity refining, advanced metallurgy, alloys and novel battery materials avoid head-to-head scale competition. Recycling and circular models near end-markets, particularly in Europe, are gaining traction, while financing, infrastructure and project-development expertise can bridge execution gaps. Partnerships with Chinese firms can also ease market entry and provide technical know-how. Success depends on managing execution risk, ESG obligations, regulatory volatility and technological change.

Challenges remain. Grid constraints create curtailment risk; policy shifts in mining, export or local-content rules can hit viability; emerging-market financing and currency risks are material; overcapacity is squeezing margins even in China; and permitting, community expectations and rapid technology shifts can upend assumptions. Strategies anchored in flawless delivery, policy alignment and selective specialisation are more robust than attempts to replicate China’s scale.

China is accelerating investment in renewables and clean-energy infrastructure to cement influence across the future energy-industrial system.China’s climate pledge, even if modest to some, signals leadership in deployment, industry and geopolitics. For global investors, the contest now needs to look beyond generation, into the next frontier which lies in the industrial value chain. Success requires targeted investment in three critical areas: infrastructure (grids, storage, and smart systems to enable clean power), diversified supply chains (mining, refining, and recycling of critical minerals, particularly in Africa and Latin America), and niche technology specialisms (advanced materials and novel battery technology). This includes control of minerals, processing, finance and trade corridors. The winners will look beyond generation and treat clean energy as a comprehensive industrial race to be leaders in the new industries.

1. IEA -World Energy Investment 2025 - February 2025

2. BNEF - New Energy Outlook 2025 - April 2025

3. IFC-Amundi Green Bond report - June 2025

4. Chart: Oil consumption sourced from BP Yearly Statistical Review of World Energy and IEA Oil Markets Report; Industrial production output sourced from National Bureau of Statistics of China

5. Chart 2: IEA Global Critical Minerals Outlook 2025 - May 2025