The Inevitable Case for Natural Capital in a Politically Fragmented World

Authors: Justin Kew, Martin Sacchi, Xixi Jiang

In today’s geopolitical context, within the investment landscape, the very definition of responsible investing is undergoing a profound realignment. Political polarisation, particularly in the United States, and some pushback within the European Union, have created headwinds for broad-based environmental, social and governance (ESG) alliances and frameworks. This turbulence might suggest a slowdown, but it is in fact driving a beneficial shift: moving from generic “green” slogans towards tangible, quantifiable outcomes.

We believe that the core opportunity lies in recognising nature as infrastructure, a foundational asset class providing indispensable, non-substitutable services such as clean water, soil fertility and critical materials. This essential realisation reframes environmental investment not as a risk filter but as a strategy for long-term economic resilience.

This shift is steering capital towards strategies of system-level investing, moving from managing assets based on abstract labels to assessing their ability to manage entire natural systems. The next phase of capital allocation will be defined by those who can quantify nature’s value first and scale it across markets before it becomes a regulatory requirement.

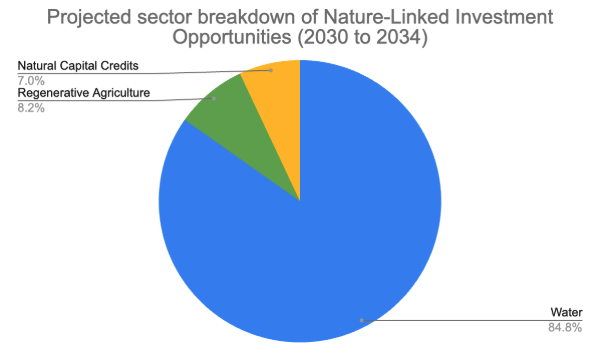

This post maps the growing investment opportunities in nature, specifically in water, materials (circularity and biodiversity offsets) and agriculture, by examining three key shifts across the global economy.

I. Investment Industry Shifts: From Labels to Lattices

The investment industry is adapting to political uncertainty by pursuing more specialised, outcomes-based strategies that mitigate broad political risk. This focus is directing capital towards the solutions needed to support ecosystems, driving a new wave of specialisation.

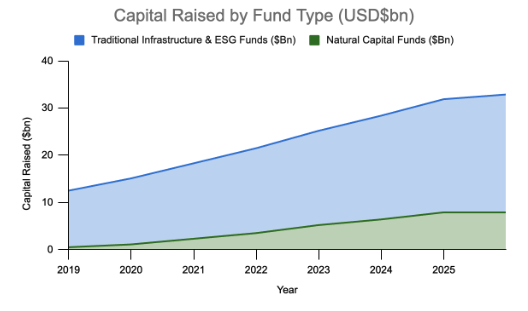

The Rise of New Attribute Financing

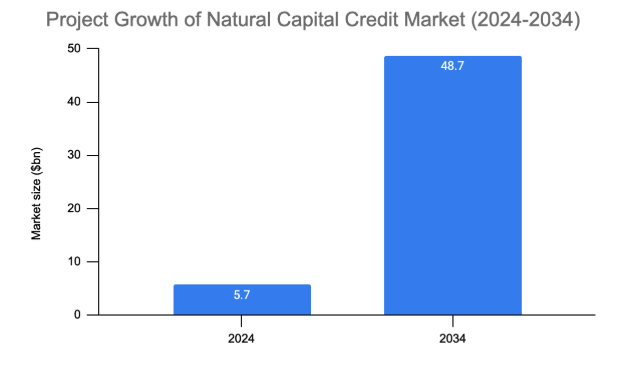

The era of relying solely on carbon reduction is maturing. The long-term trend points to new non-carbon attributes gaining traction as sustainability data improves. As disclosure frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD), the International Sustainability Standards Board (ISSB) and the EU’s Corporate Sustainability Reporting Directive (CSRD) gain adoption among corporates, so too will the credibility of financial products linked to biodiversity, water use and a just transition. This transition is already generating significant growth projections.

Institutions are signalling their confidence with record fundraising: closed-end natural capital funds focused on agrifood and forestry raised USD 7.9 billion in the first half of 2025, matching the record set in H1 2024. This capital is driven by the potential for sustainable, long-term returns and a low correlation to traditional asset classes. The market is rewarding managers with proven track records and robust ESG integration.

Chart 1: The Emergence of Natural Capital as an Asset Class

The exponential growth of the credit market shows that investors are ready to back tangible outcomes beyond carbon, such as watershed services and soil quality improvement. Natural capital investments, once fragmented across forestry and farmland, are now consolidating into a distinct asset class, poised to redefine risk management.

Chart 2: Market expansion of natural capital credit up with projected CAGR of 24.1%

II. Real Economy Shifts: The Core of Natural Resource Resilience

The real economy is where the impacts of planetary boundaries are felt most acutely, creating urgent demand for solutions in water, materials, and agriculture.

Chart 3: Water infrastructure dominates the opportunity set, with agriculture and biodiversity credits fast scaling

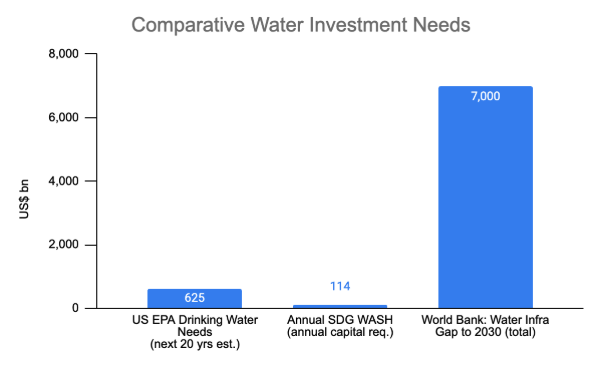

1. Water: The $591 Billion Imperative for Resilience

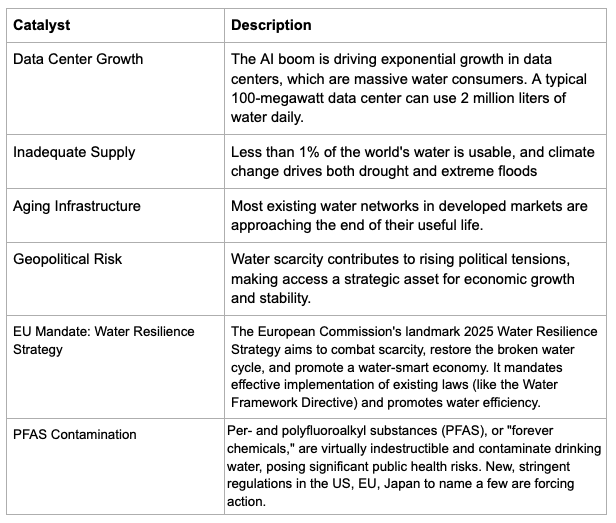

The need for clean water and resilient water infrastructure is paramount, driven by aging municipal systems, industrial demands and new pollution risks.

Chart 4: The gap globally is significant even in developed markets

China is leading extensive public sector investment, building the world’s largest and most comprehensive water infrastructure system. Total investment in water conservancy projects during the 14th Five-Year Plan period (2021–2025) is expected to exceed RMB 5.4 trillion (approximately USD 757 billion), 1.6 times higher than in the previous five-year period. This spending focuses on large-scale water transfer, flood and drought defences, and increasing rural tap water coverage to 96%. China’s investment also includes mandates for a sewage treatment rate exceeding 95% in county-level areas and increased utilisation of recycled water.

Investment opportunities in this sector remain underexplored despite the substantial capital requirements, particularly in technology and infrastructure.

Technology: Investment is needed in advanced membrane filtration, activated carbon adsorption (for PFAS removal), water recycling systems, and AI-driven leak detection and optimisation.

Infrastructure: The global market for water and wastewater treatment technologies is projected to reach USD 591.2 billion by 2030. Public-private partnerships (PPPs) in emerging markets and smart grid upgrades in developed markets will be key drivers of this growth.

The need for adaptation is creating a surge in private climate adaptation finance. The economic case is undeniable: every $1 invested in adaptation can help avoid up to $43 in potential damages.

Chart 5: Ageing assets in the US and EU drive urgent reinvestment; China’s newer but expanding system shows its scale advantage

Chart 6: Growth in water & wastewater treatment technologies expected to grow at CAGR of 11%

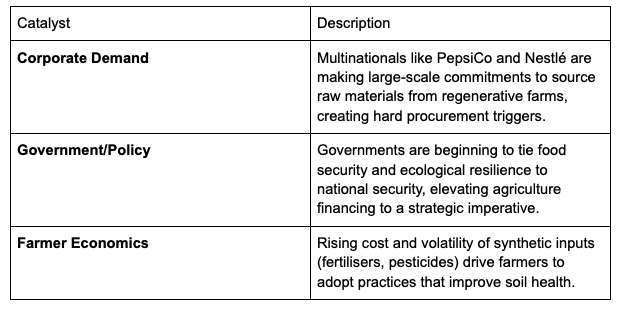

2. Agriculture: From Risk Source to Resilience Driver

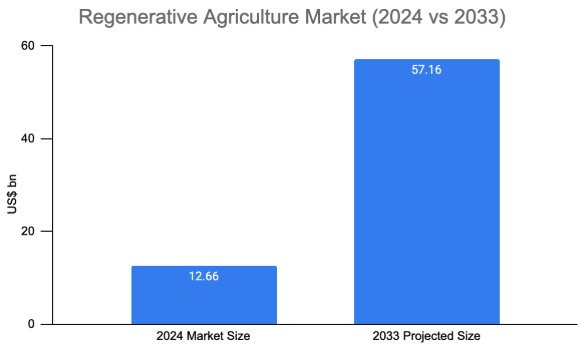

The shift towards regenerative agriculture is accelerating, moving from a niche practice to a core focus of sovereign and development finance. This momentum is driven by the urgent need to secure global food systems, with projections indicating that crop yields could decline by up to 30% by 2050 without intervention.

Outcome-linked bonds in agriculture, tied to measurable soil and water metrics, are expanding in the market, and more innovative instruments of this kind are expected to emerge. In terms of direct investment, capital is increasingly flowing into technologies such as biologicals (natural inputs) and MRV (measurement, reporting and verification) systems for soil, water and biodiversity, which are anticipated to grow further.

Chart 7: Projected Growth of the Regenerative Agriculture Market

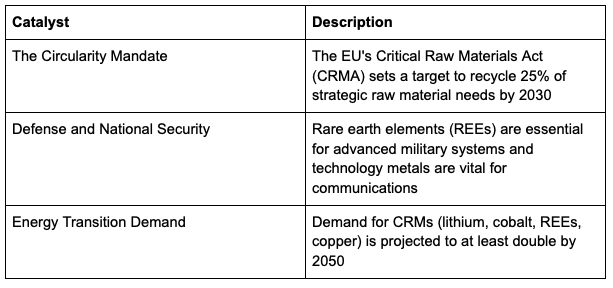

3. Materials: Geopolitics and the Energy Transition Build-Out

Investment in materials is increasingly shaped by the intersection of geopolitical rivalry, supply chain security and the surging demand for critical raw materials (CRMs) essential to the energy transition and defence sectors.

China’s dominance over the rare earth supply chain, controlling nearly 90% of global processing, has been explicitly leveraged as a geopolitical tool. In October 2025, China expanded export controls on rare earths and related technologies, including permanent magnets, directly targeting foreign defence and semiconductor industries.

The United States responded by escalating the trade conflict, with President Donald Trump swiftly threatening a “massive increase” in tariffs, including a potential 100% levy on Chinese imports, in retaliation for what he described as China’s “hostile” actions.

Chart 8: China’s position dominance of the global rare earth value chain

Concentrated supply chains threaten national security and the entire energy transition build-out. Circularity reduces reliance on volatile virgin materials and imports.

There are many investment opportunities in this sector. To name a few, investment in advanced recycling technologies (for EV batteries and wind turbines) and remanufacturing/refurbishment models to meet EU recycling mandates has been gaining momentum. On the other hand, direct investments and long-term offtake agreements in domestic and allied mining/processing projects, technology to enhance mining finance are just a few innovative solutions out there.

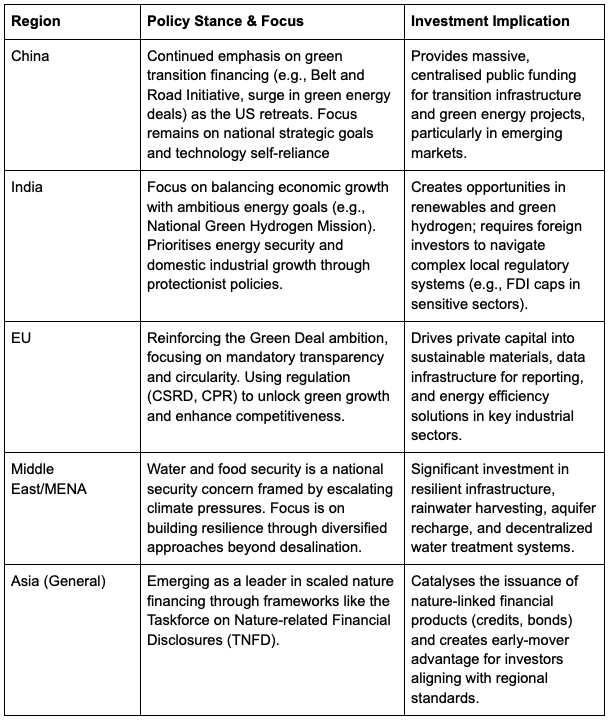

III. Policymaker and Regulator Views: A Coordinated Global Push

Despite political fragmentation in the West, key global economies are driving alignment towards nature-based solutions, emphasising resilience and security.

Conclusion

The policy environment is moving toward rewarding system-level investing—an approach that integrates the health of environmental systems (like water basins and soil quality) into the investment process. This ability to successfully navigate the political noise, translate nature's value into credible financial terms, and effect real-world change is what will secure new mandates in the years to come.

The next stage of responsible investing won't be defined by what you exclude, but by how strategically and effectively you engage with the real world to build resilience and drive measurable, nature-positive outcomes. This requires deep sector expertise, policy acumen, and an unwavering focus on impact, enabling capital to flow into solutions that tackle complex, interconnected challenges across water, materials, and agriculture.

Sources:

Chart 1: Preqin, NatureVest, PitchBook estimates as Dec 2024

Chart 2: InsightAce Analytic (2025)

Chart 3: BCC Research (2025), Grand View Research (2025), InsightAce (2025)

Chart 4: US EPA, UN and World Bank (2025)

Chart 5: OECD, US EPA, China 14th Five-Year Plan (2021–2025)

Chart 6: BCC Research 2025

Chart 7: Grand View Research 2025

Chart 8: Z2Data 2025; CSIS 2025