2026 OUTLOOK: NAVIGATING THE AGE OF CONTROLLED DISORDER

Author: Justin Kew, Martin Sacchi

In this regime, broad beta is a blunt instrument. Returns are likely to be driven by three structural forces:

Governments as marginal allocators through industrial, security and climate policy;

Geopolitical rewiring of trade, energy and technology flows;

Twin supply-side shocks from AI and climate, creating simultaneous bottlenecks and productivity opportunities.

The result is a market that rewards thematic precision, balance-sheet strength and policy alignment, while penalising business models exposed to chokepoints, under-priced regulation and weak human-capital franchises.

Looking back, do you know…?

In 1873, the “Panic of 1873” ended the first great age of globalisation and ushered in decades where politics, not markets, drove capital flows—an early prototype of today’s policy‑engineered world.

In the 1970s, just two oil shocks were enough to triple global inflation and permanently change how investors priced energy and geopolitical risk—a reminder that supply shocks can reset entire market regimes.

Since the late 1990s, world trade grew faster than GDP almost every year; since around 2011, that pattern has broken, with trade intensity flattening even as digital connectivity soared—a sign that “more globalisation” is no longer automatic.

Today, more than 80% of the value of major stock indices comes from intangibles like software, brand and human capital, yet most accounting systems still treat people as a cost and not as an asset.

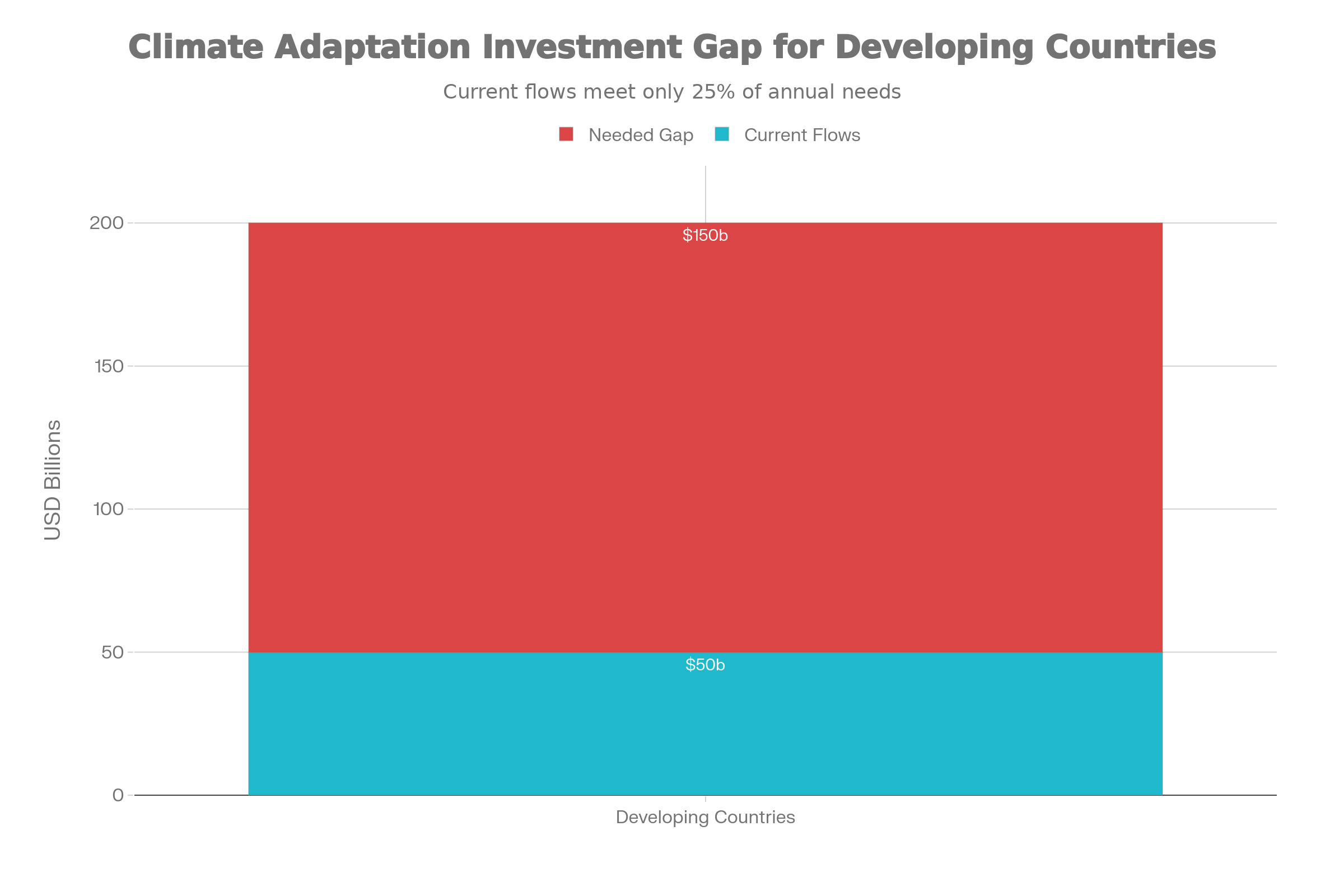

Climate adaptation needs in developing countries alone are estimated in the hundreds of billions of dollars per year, but only a fraction is financed—turning resilience from a policy slogan into one of the largest under‑built asset classes of the next decade

I. What to look out for in 2026?

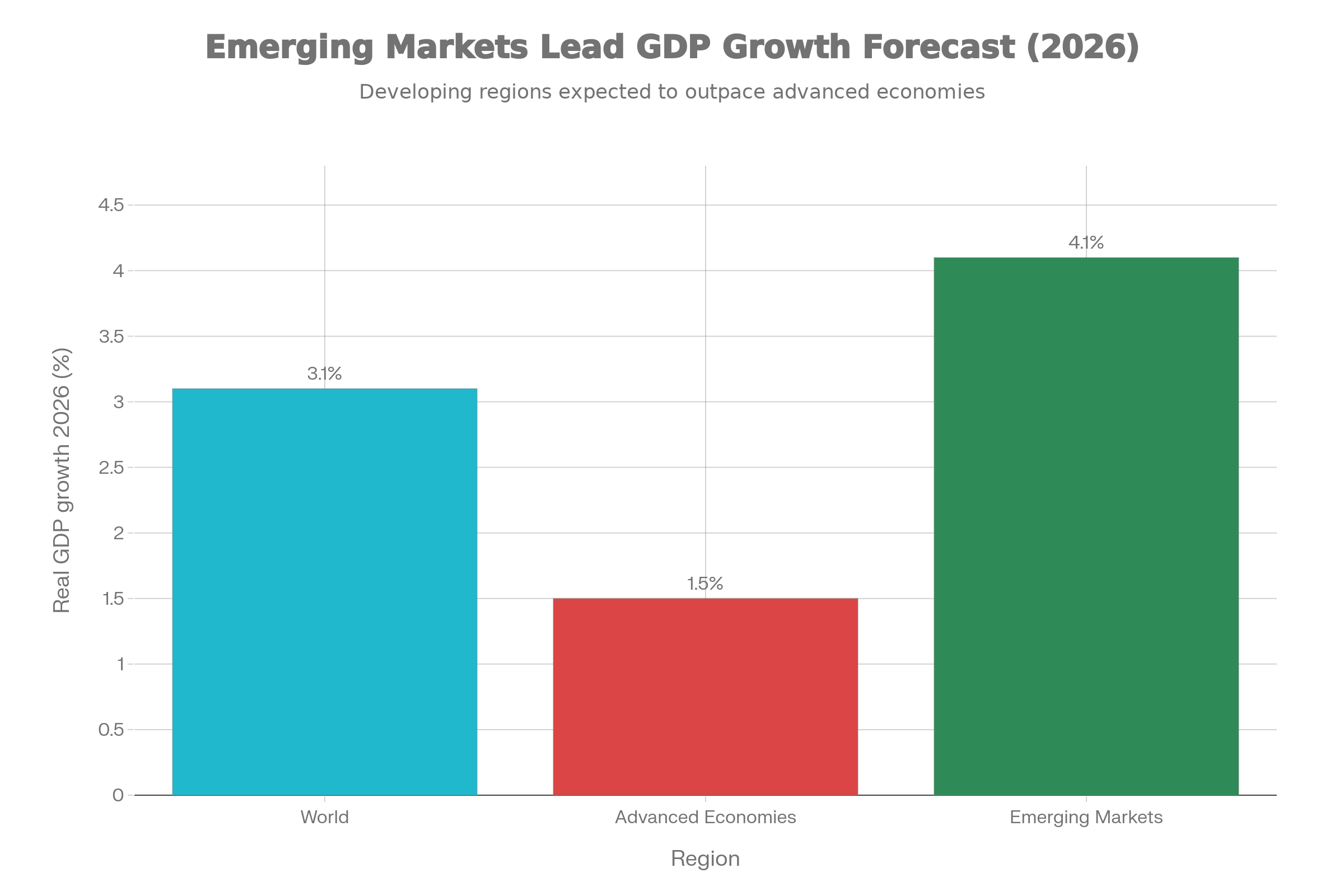

Global growth is structurally slower. The IMF projects world GDP growth of 3.1% in 2026, down from 3.3% in 2024, with advanced economies stuck at 1.5% and emerging markets delivering just above 4%—a widening gap that reflects persistent policy frictions and uneven recovery. For institutional investors this low growth regime suppresses beta returns and elevates the importance of active capital allocation, balance sheet resilience and jurisdictional exposure, with alpha increasingly driven by structural themes, policy asymmetries and asset level underwriting rather than a rebound based on economic cycles.

Geopolitics is now a balance-sheet variable. Trade barriers, export controls and sanctions regimes are no longer cyclical disruptions but embedded structural policy tools, reshaping supply chains and capital flows in real time across all major economies.

Intangible assets comprise 80% of equity valuations. Yet corporate disclosure on culture, talent, brand and organisational capability remains poor, creating a systematic repricing opportunity as regulatory regimes (CSRD, CSDDD) force transparency in 2026.

Climate adaptation financing has a USD 200+ billion annual gap. While global adaptation needs for developing countries are estimated at USD 200–365 billion per year through 2035, current flows are a fraction of this, creating a multi-year capex pipeline in water, grids and urban resilience.

Governments however, rather than markets, are the marginal allocators of capital. Industrial policy, security spending and climate investment programmes now dwarf traditional private-sector capex cycles, narrowing the cost of capital for policy winners and widening equity premiums for policy outsiders.

We identified six themes anchor the 2026 opportunity set:

1. Industrial Policy & Strategic Capex

Governments compress cost of capital for targeted sectors, supporting multi-year earnings visibility.

2. Geopolitics & Strategic Decoupling

Friend-shoring channels capital to India, ASEAN, Mexico, Gulf;

Supply-chain premiums widen.

3. AI, Automation & Power Systems

AI capex cycle creates pricing power for genuine enablers (semiconductors, data-centre infrastructure, grids).

4. Climate Adaptation & Hard Assets

USD$200bn+ annual financing gap drives multi-year resilience capex;

Infrastructure-like returns.

5. Intangibles, Regulation & Human Capital

CSRD disclosure and workforce metrics elevate culture, talent and governance into explicit valuation drivers.

6. Culture, Sports & Luxury

Scarce assets with identity-driven growth;

Sports franchises and luxury houses monetise attention and belonging.

The playbook is to be selective, not defensive. That means:

Overweighting policy-anchored capex and climate-resilience assets;

Favouring AI and power-system enablers over broad tech;

Backing friend-shoring hubs and financials with exposure to new trade corridors;

Upgrading portfolios along intangible dimensions—governance, talent, brand, culture, where return dispersion is likely widest;

Using scenario analysis and disciplined hedging for geopolitical and climate tails rather than wholesale de-risking.

In an age of controlled disorder, investors who systematically map and underwrite these structural themes, not the headline macro noise, are positioned to capture the bulk of 2026's alpha.

II. THE MACRO BACKDROP: SLOW GROWTH, HIGH DISPERSION

The IMF's October 2025 World Economic Outlook projects global GDP growth of 3.1% for 2026, down from 3.3% in 2024. This represents a structurally slower but still positive backdrop, with significant regional dispersion:

Advanced Economies: 1.5% (U.S. ~2.1%, Eurozone ~0.9%)

Emerging Markets: 4.1% (India ~6.4%, China ~4.2%, Vietnam ~8%)

World: 3.1%

IMF-style forecast: slower but positive global growth in 2026, led by emerging markets

This is not a recessionary environment, but neither is it one where traditional index beta delivers strong returns. Growth is constrained by trade frictions, fiscal headwinds in developed economies, and structural supply-side bottlenecks in energy, semiconductors and skilled labour. Dispersion across countries is wider than historical averages, creating alpha opportunities for investors who can identify policy-anchored winners and losers.

Inflation: Gradual Convergence, Not Deflation

Inflation is expected to gradually converge toward central-bank targets in 2026, but without a return to the ultra-low regime of the 2010s. Persistent service-sector inflation, supply-chain de-risking and structurally higher energy price floors imply that monetary and fiscal policy will remain tighter than in the post-2008 period, anchoring higher real discount rates and compressing equity multiples relative to the 2021–2023 cycle, with capital increasingly favouring pricing power, cash-flow visibility and balance-sheet strength.

Trade: Fragmentation Over Expansion

Trade as a share of global GDP has stalled since 2011, despite gains in digital connectivity. In 2026, trade volumes are likely to continue lagging GDP growth as tariffs, export controls, localisation requirements and strategic subsidies suppress traditional flows. The proliferation of bilateral and plurilateral trade agreements outside the WTO framework is creating a fragmented rulebook, increasing compliance and operating costs for exporters while accelerating supply-chain re-routing and capital reallocation across regions in real time.

Risk: Geopolitical, Energy, Climate and Regulatory

Geopolitical fractures (Ukraine, Taiwan, Middle East), energy supply constraints, climate shocks and tighter regulation remain embedded sources of volatility rather than tail risks. As a result, the distribution of potential outcomes in 2026 is materially wider than in typical cycles, reinforcing the need for explicit scenario analysis, balance-sheet stress testing and tail-risk hedging, rather than reliance on single-point forecasts.

The Bottom Line on Macro

This is not a beta market. Investors require structural, policy-anchored frameworks capable of identifying where returns will persistently sit above or below trend across sectors, geographies and capital structures. Broad index exposure to equities and credit is no longer sufficient in an environment defined by regulation, energy constraints and capital intensity; durable outperformance increasingly depends on thematic precision, asset selection and an understanding of how policy, infrastructure and balance-sheet strength translate into cash-flow resilience.

III. SIX FOCUS THEMES FOR 2026

Theme 1: Industrial Policy & Strategic Capex

The Thesis

Industrial policy is no longer marginal; it is the largest single driver of capex heading into 2026. The EU's Net-Zero Industry Act (EUNZIA) and Defence program, the U.S. Defence Bill and CHIPS funding, and Asian subsidy regimes for semiconductors, batteries and strategic manufacturing collectively re-engineer the investment landscape.

The EU aims to ensure that at least 40% of clean-tech manufacturing occurs within Europe by 2030. The U.S. continues to deploy IRA, CHIPS and defence-linked industrial expansions. Japan, Korea, China and India channel subsidies into semiconductors, batteries, strategic materials and advanced manufacturing, creating a global subsidy race reshaping supply chains, pricing power and equity valuations.

Why it matters in 2026

From theory to execution: Industrial policy moves from design documents to real permitting decisions, local-content rules and subsidy allocations, directly hitting the P&L and cash-flow statements.

Governments as risk absorbers: Public-sector backing narrows the cost of capital for favoured technologies and sectors while implicitly penalising laggards.

Capex visibility improves: Earnings streams become more predictable in grids, critical minerals, clean-tech manufacturing, defence and automation as public procurement creates multi-year pipelines.

What to watch in 2026

EUNZIA implementation details, especially local-content thresholds, subsidy ceilings and enforcement outcomes.

U.S. debates over IRA durability, fiscal space and potential policy rollbacks under new administrations.

Asian funding programmes in semiconductors, EV supply chains and advanced manufacturing corridors as a barometer of regional policy commitment.

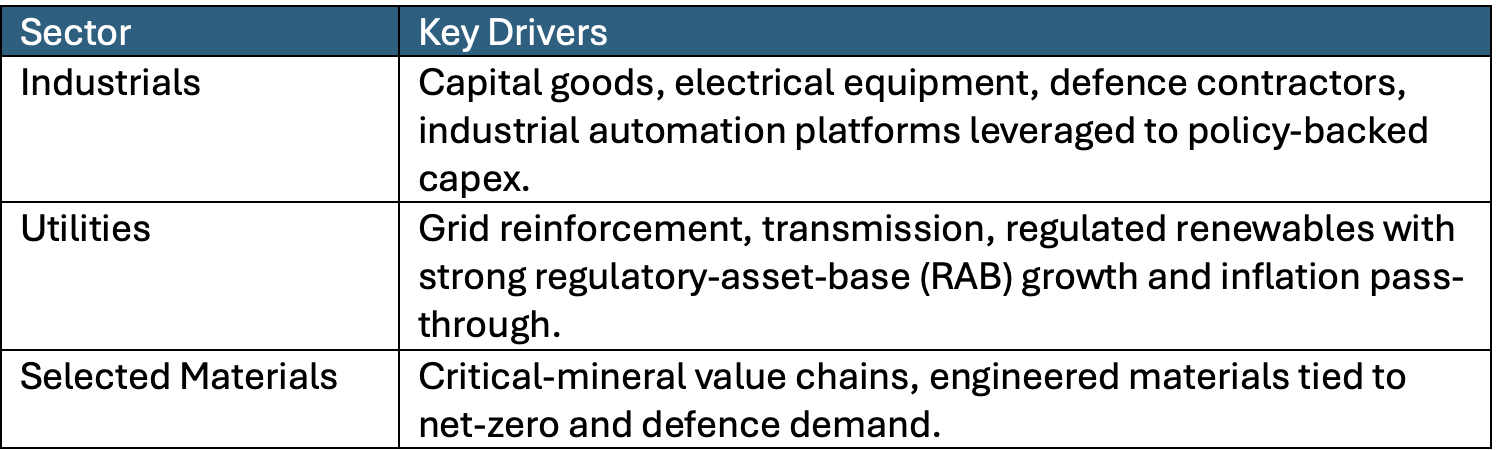

Key Sector Drivers

Overweight capital goods, utilities and industrials with direct exposure to policy-backed capex programmes. Prefer firms with long-dated PPAs, regulated RAB growth or government contracts that lock in margins and reduce refinancing risk.

Theme 2: Geopolitics & Strategic Decoupling

The Thesis

The world has stopped converging and is reorganising into three overlapping blocs: U.S.-aligned, China-aligned, and a large "non-aligned" group—including India, ASEAN, Mexico and the Gulf—that benefits from competing powers. Tariffs, export controls, anti-subsidy probes and selective market access are now structural policy norms, not cyclical disruptions.

Companies are actively redesigning supply chains to minimise exposure to geopolitical choke points, sanctions and export controls. "Friend-shoring" strategies channel capital into swing states with improving governance, infrastructure and manufacturing capacity.

Why it matters in 2026

Supply-chain re-routing: Companies are willing to pay a premium for supply-chain diversity, moving manufacturing and sourcing away from geopolitical hotspots.

FDI shifts to beneficiary geographies: India, Vietnam, Malaysia, Indonesia and Mexico are attracting record inflows as firms de-risk China and other vulnerable jurisdictions.

Equity premiums widen: Companies that successfully re-engineer their footprint earn a valuation and liquidity premium; those anchored in vulnerable geographies face de-rating risk.

What to watch in 2026

EU trade-defence actions (anti-subsidy investigations), U.S. tariff policy rollouts and China's countermeasures across technology, clean-tech and defence sectors.

FDI inflows and government-investment flows into India, Vietnam, Malaysia, Indonesia and Mexico as hard signals of supply-chain re-routing.

Sector-specific restrictions in semiconductors, defence, critical minerals and clean-tech components as geopolitical leverage points.

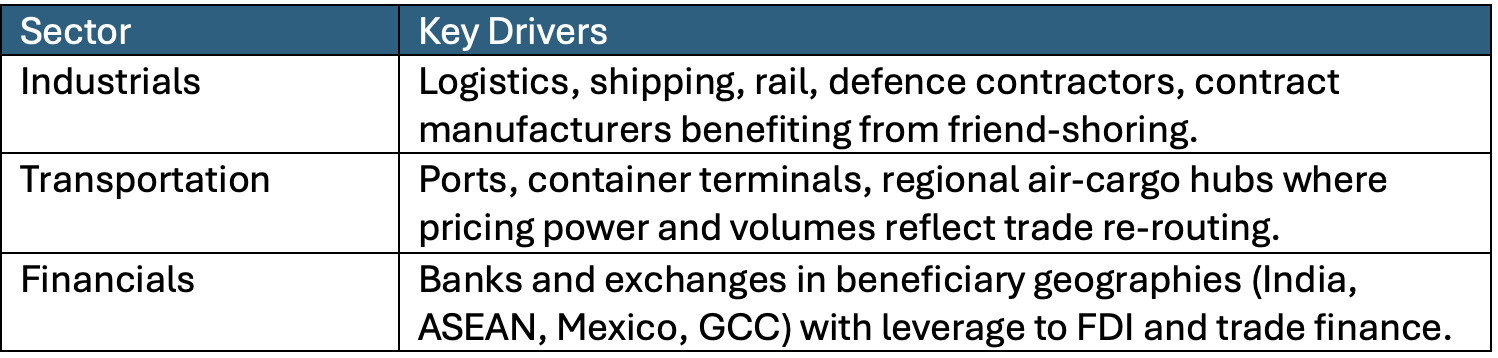

Key Sector Drivers

Overweight industrials and transportation with direct exposure to friend-shoring hubs and supply-chain re-routing. Favour banks and financials in India, Southeast Asia and Mexico with strong sovereign credit and exposure to rising FDI flows.

Theme 3: AI, Automation & Power Systems

The Thesis

AI has shifted from a software/tech cycle to an infrastructure cycle, with data-centre, grid and cooling capacity becoming binding constraints in most major economies. Power availability and permitting are now as central to AI deployment as algorithms and model architecture.

Data-centre demand is expected to double by 2030 as enterprises and hyperscalers scale AI workloads, implying sustained capex into semiconductors, cooling systems, high-voltage equipment and specialised real estate.

Why it matters in 2026

Earnings dispersion widens: The gap between AI "users" (software companies deploying AI tools) and AI "enablers" (hardware, semiconductors, power, cooling) is likely to widen sharply as capex pipelines mature and pricing power diverges.

National competitiveness hinges on power: Access to cheap, reliable, low-carbon power; robust grids; and efficient digital permitting regimes are now prerequisites for economic leadership.

Productivity gains require human capital: Real returns on AI deployment depend on organisational readiness, culture and workforce capability, not just tool adoption.

What to watch in 2026

Rollout of AI regulation (EU AI Act, U.S. guidelines, Asian regulatory pilots) and its effect on compliance costs and innovation velocity.

Announcements of hyperscale data-centre clusters and long-term power-purchase agreements (PPAs) as leading indicators of regional AI winners.

Valuation stress in AI-exposed tech, semiconductors and data-centre REITs as markets test earnings durability and power constraints.

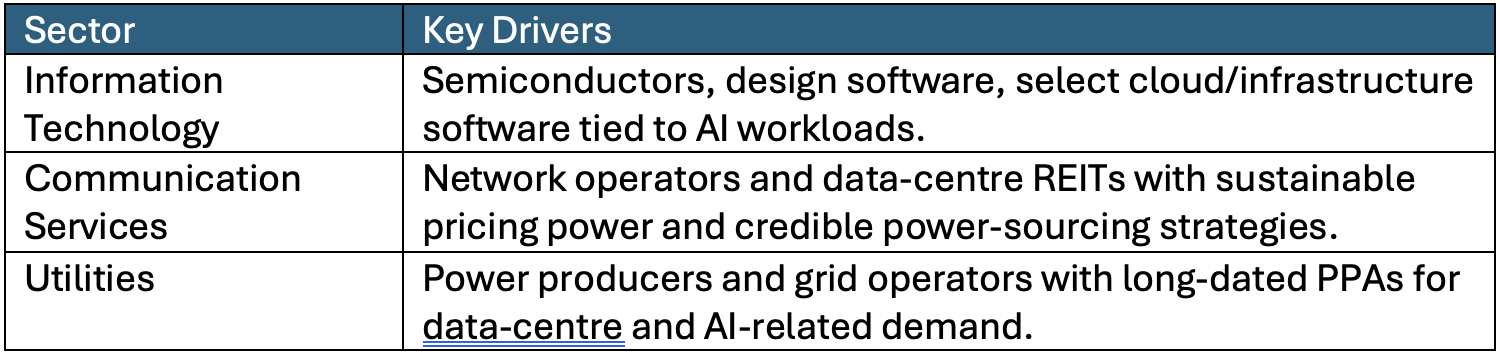

Key Sector Drivers

Theme 4: Climate Adaptation & the Hard-Assets Supercycle

The Thesis

Climate adaptation is moving from policy aspiration to a distinct investible capex theme, as governments, cities and companies confront rising physical-risk losses and resilience gaps. Adaptation needs in developing countries alone are estimated at USD 200–365 billion annually through 2035, yet current finance flows are a fraction of this, creating a durable multi-year investment pipeline.

Adaptation finance gap: current flows fall well short of estimated needs in developing countries

Beyond adaptation, climate volatility, resource scarcity and security imperatives are converging into a broader hard-asset super cycle, with governments deploying billions into grid expansion, water infrastructure, energy transition and domestic mineral value chains.

Why it matters in 2026

Adaptation enters execution phase: Spending shifts from concept studies to concrete contract awards in flood defence, water systems, heat-resilient buildings, grid hardening and climate-smart agriculture.

Transition projects move past permitting bottlenecks: Energy-transition capex accelerates as regulatory reforms (zoning, environmental permits) reduce friction.

Climate disasters repricing assets: Sudden repricing in insurance, utilities and infrastructure stocks following severe weather events reinforces the resilience premium.

What to watch in 2026

Adaptation focus: National adaptation plans and cross-border climate-resilience initiatives as government commitment signals; procurement announcements in water, flood and urban resilience projects.

Resources & minerals: New export restrictions, environmental permitting shifts and supply-chain bottlenecks in critical minerals, lithium, cobalt and refined materials.

Market signals: Catastrophe bonds, parametric insurance growth and capital-market pricing of climate risk as indicators of systemic repricing.

Where capital flows (within adaptation & hard assets)

Water and urban systems: Expansion and upgrading of water treatment, leakage reduction, storm-water systems and nature-based flood management in fast-growing cities, often via PPP or regulated-utility structures.

Resilient power and grids: Hardening of transmission and distribution networks against heat, storms and wildfire risk, plus distributed solutions (microgrids, storage) in vulnerable regions.

Agriculture and land use: Irrigation, drought-tolerant inputs, precision farming and soil-restoration projects designed to stabilise yields and protect export earnings in climate-exposed economies.

Risk transfer and insurance: Growth in catastrophe bonds, parametric insurance and public-sector backstops that monetise resilience and transfer tail risk to capital markets.

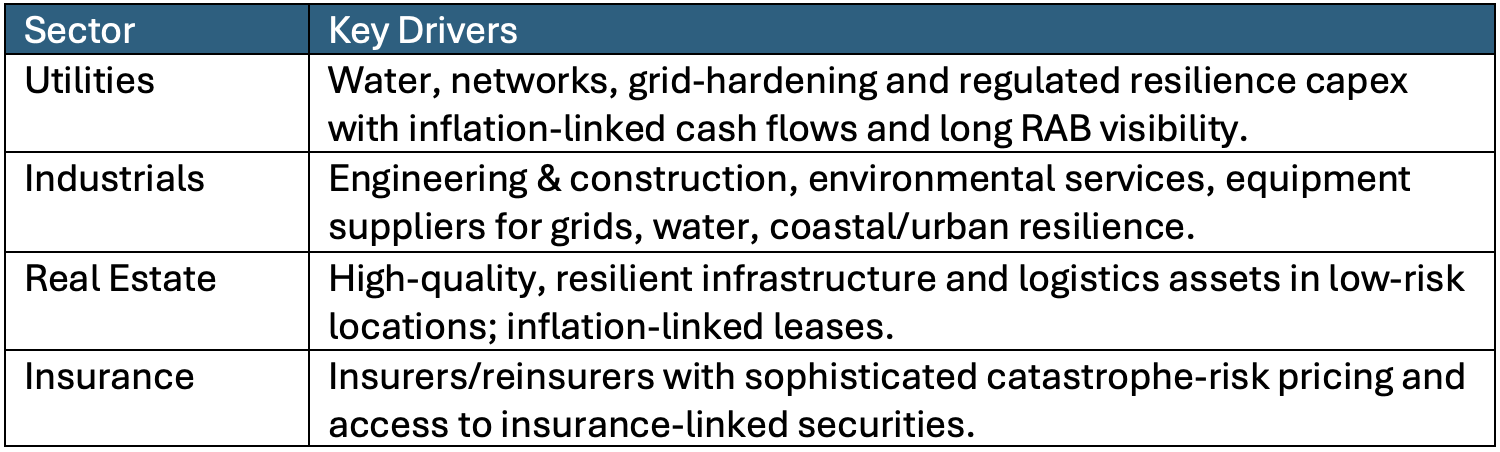

Key Sector Drivers

Treat adaptation as a distinct long-duration, infrastructure-like allocation. Overweight utilities with water and grid-resilience exposure; engineering firms with government contracts; specialised insurance and reinsurance with underwriting discipline and access to capital markets; resilient real estate in low-risk jurisdictions.

Theme 5: Intangibles, Regulation & Human Capital

The Thesis

More than 80% of corporate value in major indices is now intangible—brand, IP, software, culture, organisational capability and human capital. Yet this value remains systematically mis-priced because disclosure has been limited and inconsistent.

The 2026 CSRD cycle will change this. Companies will need to disclose workforce investments, capability development, supply-chain labour quality, safety, diversity and retention, yielding richer datasets for investors.

Regulation—increasingly intrusive and data-rich—will also reshape valuations. EU and global regimes are forcing disclosure on climate transition, supply-chain risk, governance and governance-linked legal disputes, allowing investors to price resilience and licence-to-operate risk with greater granularity.

Why it matters in 2026

Visibility into intangible drivers: CSRD and related disclosures lift the veil on culture, talent and governance, allowing investors to price these factors systematically for the first time.

Human-capital quality as valuation driver: Firms with strong culture, talent retention and organisational capability are better positioned to monetise AI, manage transition risk and navigate complex regulatory regimes.

Compliance as competitive moat: Capabilities in data management, verification, scenario planning and regulatory navigation become investible competitive advantages, supporting margin expansion and lower cost of capital for leaders.

What to watch in 2026

First full CSRD reporting cycle outcomes and assurance quality; market reaction to disclosure surprises around workforce, governance and transition risk.

Litigation and enforcement actions under supply-chain due-diligence laws (CSDDD, Modern Slavery Act) as indicators of which firms are de-risking.

Talent shortages in AI-adjacent sectors and regulated industries (financials, healthcare, energy) as drivers of wage inflation and margin pressure.

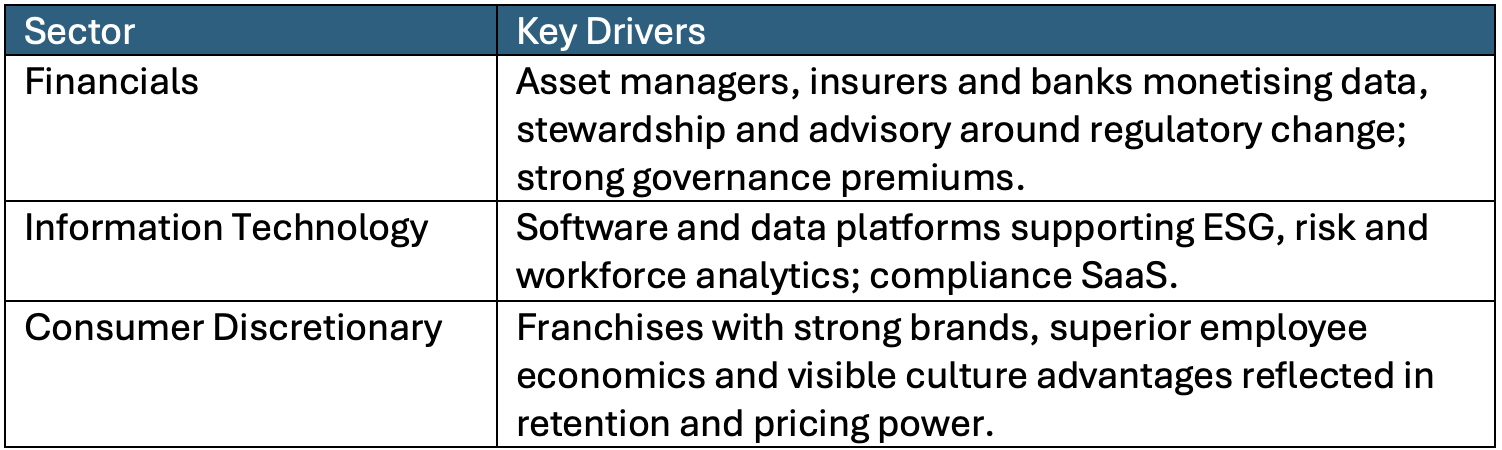

Key Sector Drivers

Overweight financial services firms with strong compliance capabilities and ESG/stewardship practices; software firms providing enterprise risk and workforce analytics; consumer discretionary firms with visible brand moats and superior talent retention metrics. Avoid firms with weak governance, high litigation risk or poor workforce-quality disclosure.

Theme 6: Culture, Sports & Luxury

The Thesis

Sports and luxury together form a broader culture and attention complex, where scarce content, brand equity and identity-driven growth can translate into above-trend nominal growth even in a slower macro environment.

Sports has matured into a scalable institutional asset class spanning media rights, franchises, infrastructure, athlete IP and data analytics. Private equity and sovereign funds are now core players, and women's sports are on a structurally higher growth trajectory than men's properties.

Luxury is rebounding modestly in 2026 (growth 3–5%) after volatile 2024–25, but the deeper shift is structural: luxury is moving from scarcity and pricing power toward identity, community and cultural authenticity. Younger consumers demand transparent supply chains, credible narratives and community-based engagement.

Why it matters in 2026

Scarce, cash-generative assets: Sports franchises and media rights increasingly behave like infrastructure—globally marketable, with durable cash flows and limited supply.

Monetisation pathways expand: Emerging leagues in Asia and MENA, streaming platforms, sponsorship and data create multiple revenue vectors.

Culture as valuation driver: Brands with credible cultural narratives, diversified geographic demand and strong local resonance earn premium valuations and resilience through economic cycles.

What to watch in 2026

Sports: Rights renewals for major leagues; cross-border franchise acquisitions and sovereign-fund entries; monetisation of women's sports through sponsorship, data and broadcast deals.

Luxury: Consumer sentiment in China, U.S. and GCC; luxury group restructuring and pricing-architecture shifts; authenticity and cultural-IP strategies among independent designers.

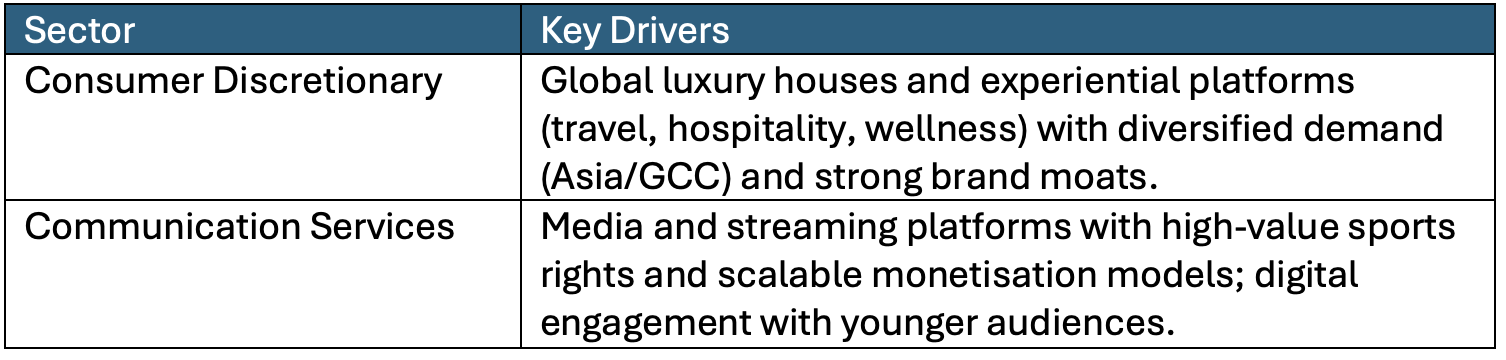

Key Sector Drivers

Overweight global luxury houses with strong cultural narratives, diversified geographic exposure and high-margin experience offerings. Favour media and streaming platforms with sports rights portfolios and younger audience reach. Avoid pure luxury-goods names without digital/experiential diversification or Asian exposure.

IV. PORTFOLIO CONSTRUCTION: THE THEMATIC OPPORTUNITY SET

The six themes to the key GICS-style sectors where upside is most concentrated:

Mapping final 2026 themes to key overweight sectors

Utilities appear across three themes (Industrial Policy, AI/Power, Climate Adaptation);

Industrials across four themes;

Financials across three.

This concentrated sector overlap suggests that:

Utilities are the broadest beneficiary across multiple structural themes.

Industrials and Financials are the second-order play on policy, geopolitics and regulation.

Information Technology has significant upside in AI/enablers but downside if regulatory or energy constraints bite.

Consumer Discretionary is bifurcated: luxury winners vs. discretionary losers in a lower-growth environment.

Communication Services benefits from sports/media rights and AI infrastructure but faces regulatory risk.

V. KEY RISKS & DOWNSIDE SCENARIOS

Geopolitical Escalation

If trade barriers escalate further or sanctions expand into new sectors (e.g., European defence supply chains), supply-chain premiums could compress and industrial-policy winners could face margin pressure. Exposure to beneficiary geographies (India, ASEAN, Mexico) would be most de-rated.

Mitigation: Diversify supply-chain exposure; favour firms with multi-continent footprints; use geopolitical hedges.

Energy Supply Shock

A disruption in oil, gas or electricity supply (e.g., escalation in Middle East, constraint in nuclear-heavy France) could spike energy costs and undermine the AI/data-centre narrative by raising power costs and regulatory scrutiny. Utilities with high fixed costs and regulated rate bases would suffer.

Mitigation: Stress-test power-purchase-agreement terms; favour nuclear/renewables/hydro baseload; monitor political risk in key energy-exporting regions.

Regulatory Backlash on AI

If AI regulations become unexpectedly stringent or if energy/cooling constraints force public-sector intervention, capex pipelines in data centres could stall and semiconductor demand could soften. Tech earnings would compress.

Mitigation: Monitor EU AI Act implementation; focus on dual-use (defence, grid) AI demand less vulnerable to regulatory constraints.

Climate Shock Severity

Unexpectedly severe climate events could trigger systemic insurance losses, sovereign credit downgrades in vulnerable countries, and sudden repricing across real estate and infrastructure. Conversely, they could accelerate adaptation capex, creating a non-linear upside.

Mitigation: Maintain discipline on catastrophe-bond sizing; avoid over-concentrated real-estate exposure in high-hazard zones; treat adaptation capex upside as optionality.

CONCLUSION: 2026 IS A YEAR FOR PRECISION, NOT BETA

The global economy enters 2026 with modest headline growth of around 3.1%, however, beneath lies unusually high dispersion and a set of deep, overlapping structural shifts across policy, geopolitics, climate and tech. Growth is slower, less synchronised and far more conditional on jurisdictional choices than in prior cycles. This is not a year where broad market beta reliably compounds. It is a year that rewards thematic precision, selective exposure and the willingness to hold active convictions through volatility.

For investors, the 2026 playbook is increasingly clear:

1. Own industrial-policy winners and avoid explicit policy targets.

Utilities, industrials and capital goods tied to grid expansion, defence, reshoring and energy transition capex benefit from durable state-backed demand. By contrast, sectors positioned as symbolic policy targets face higher regulatory risk, earnings volatility and capital constraints.

2. Position for geopolitical decoupling rather than global re-integration.

Capital is re-routing through friend-shoring hubs such as India, ASEAN, Mexico and the Gulf. Financials, logistics platforms and industrial champions embedded in these new trade corridors stand to benefit as supply chains regionalise and financing follows production.

3. Treat regulation as a source of alpha, not a compliance burden.

Regulatory regimes such as CSRD are reshaping disclosure, governance and capital allocation behaviour. Investors who systematically integrate regulatory readiness, governance quality and transition credibility into fundamental analysis gain an informational edge over those treating regulation as a box-ticking exercise.

4. Allocate to AI and power-system enablers, not narrative-driven beneficiaries.

The next phase of AI returns will accrue to firms with control over compute, power, grid access and long-term contracts. Preference should be given to businesses with contracted revenues, visible capex pipelines and balance sheets capable of absorbing infrastructure-scale investment, rather than those reliant on sentiment and multiple expansion.

5. Capture climate adaptation and hard assets as a distinct multi-year cycle.

Flood defences, water infrastructure, grid resilience and cooling systems are moving from discretionary spend to essential capex. These assets increasingly exhibit infrastructure-like characteristics: long duration, inflation linkage and policy-supported cash flows.

6. Leverage culture, sports and luxury as scarce assets rather than discretionary consumption plays.

Assets with embedded identity, heritage and global scarcity continue to compound above headline macro trends, supported by demographic shifts and wealth concentration rather than cyclical demand.

2026 will reward investors who engage with the world as it is, not as it was, and who are prepared to systematically map, underwrite and size structural themes within a disciplined risk and governance framework. The challenge is not a lack of opportunity, but the ability to separate durable structural winners from cyclical noise.

The era of controlled disorder has arrived. Those who understand its architecture, and position capital accordingly, will capture a disproportionate share of the returns.

References

International Monetary Fund (2025). World Economic Outlook, October 2025: Global Economy in Flux, Prospects Remain Dim. https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

BlackRock Investment Institute (2025). Geopolitical Risk Dashboard. https://www.blackrock.com/corporate/insights/blackrock-investment-institute/interactive-charts/geopolitical-risk-dashboard

Original document: 2026 Outlook (2025 user submission).

OECD (2025). Scaling up finance and investment for climate change adaptation. https://www.oecd.org/en/publications/scaling-finance-and-investment-for-climate-adaptation_be6892fb.html; Carbon Brief (2025). UN report: Five charts which explain the 'gap' in finance for climate adaptation. https://www.carbonbrief.org/un-report-five-charts-which-explain-the-gap-in-finance-for-climate-adaptation/

Original document and author analysis based on IMF WEO and policy literature.

IMF World Economic Outlook October 2025 – regional breakdown; LinkedIn source citing IMF growth projections for India (6.4%), China (4.2%), emerging markets (4.1%), U.S. (2.1%), advanced economies (1.5%).

Amundi Research Center (2025). Controlled Disorder: Geopolitics 2026. https://research-center.amundi.com/article/controlled-disorder-room-accidents; Deloitte (2025). Global Economic Outlook 2026. https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook-2026.html

BCG (2025). The Geopolitical Forces Shaping Business in 2026. https://www.bcg.com/publications/2025/geopolitical-forces-shaping-business-in-2026; author analysis on data-centre capex and power constraints.