Rethinking Luxury: Why Sustainable Fashion Is the Industry’s Next Big Investment

Author: Justin Kew, Martin Sacchi

The fashion industry has always been driven by innovation in practical apparel—from the trench coat and yoga pants to the invention of disposable materials in a historical context. Consumers have long sought quality, functionality and the enhancement of personal image. For decades, however, the industry has operated on a relentless cycle of new trends and mass production, promoting a linear, high-volume model of consumption that has become embedded in society.

That paradigm is now undergoing a profound transformation. Heightened awareness of resource scarcity, material integrity and the environmental cost of short-lived products is prompting a fundamental re-evaluation. Policy, technology and consumer attitudes are shifting in tandem, creating a framework in which fashion can be both profitable and sustainable.

Over the past two years, this evolution has gathered pace, spurred by decisive catalysts: major corporations issuing public sustainability commitments, a surge in innovative global solutions, and policymakers incentivising progress. This momentum is set to accelerate further.

The emerging sustainable fashion sector is defined by a circular economic model—one that keeps resources in use for as long as possible, maximises their value while in circulation and ensures recovery and regeneration at the end of each product’s life cycle. This approach extends well beyond ethical aspiration. It represents a strategy for building resilient, profitable and future-ready business models.

Ultimately, this transformation is not solely a moral concern but a significant investment opportunity—one ripe for disruption and bold innovation.

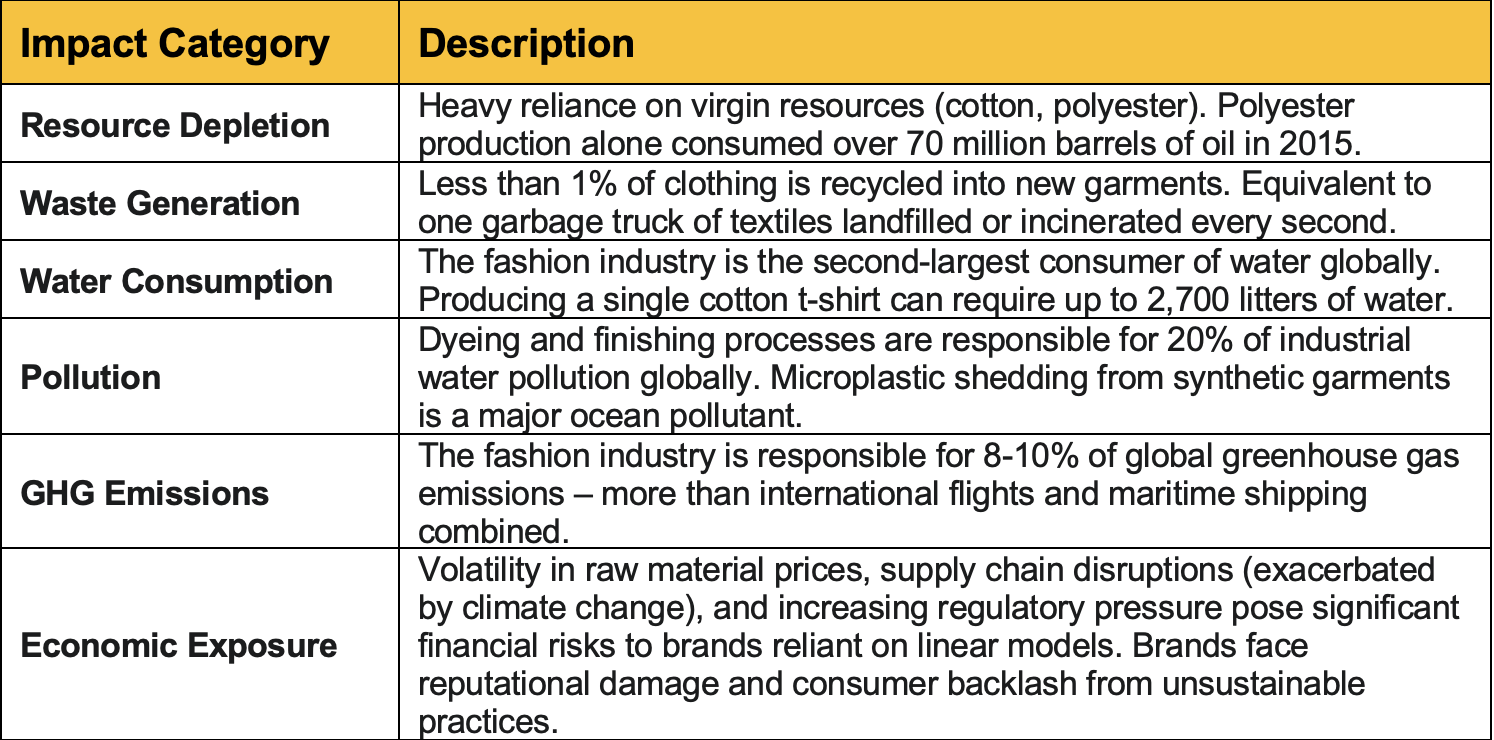

The Linear Legacy: A Materially Risky Business

The long-standing operational model of the fashion sector is now a growing liability, driven by mounting environmental and resource costs.

Exhibit 1: The Environmental & Economic Cost of Linear Fashion

Exhibit 2: Environmental Impact of Fashion

Policy as a Tailwind: From Regulation to Opportunity

Governments, particularly in Europe, are transforming sustainability from a corporate social responsibility initiative into a strategic regulatory imperative. The European Union's pioneering legislation ensures that early movers gain a competitive advantage.

The Eco-design for Sustainable Products Regulation (ESPR) is a cornerstone EU framework that replaced the previous Eco-design Directive, expanding its scope to cover nearly all physical goods on the market, aiming to improve their durability, reparability, and circularity, and to make sustainable products the norm.

The Digital Product Passport (DPP) is a mandated, structured digital record accessible via a data carrier (like a QR code) that will store and share comprehensive sustainability, circularity, and traceability information about a product across its entire value chain to empower consumers and recyclers.

EU Strategy for Sustainable and Circular Textiles outlines ambitious targets for waste reduction, increased recycling, and tackling microplastic pollution.

This means:

Design for Durability: Products must be made to last, reducing the incentive for fast fashion's planned obsolescence.

Mandatory Recycled Content: Brands will be required to use a certain percentage of recycled fibres.

Brands failing to adapt to these new market conditions face substantial fines and competitive disadvantages. The regulatory push for circularity in fashion is fundamentally driven by Double Materiality, particularly under the EU's Corporate Sustainability Reporting Directive (CSRD).

Double Materiality: Linking ESG to the Balance Sheet

The principle of Double Materiality, which underpins the EU’s CSRD, demands that companies quantify sustainability risks from two perspectives:

Impact Materiality (The "Inside-Out" View): How the company's operations and value chain affect the environment and society.

Financial Materiality (The "Outside-In" View): How sustainability issues create financial risks or opportunities for the company.

This explicitly ties circularity to financial planning. For the fashion industry, nearly every major environmental and social issue is material under both perspectives, forcing a fundamental shift in strategy.

Exhibit 3: Double Materiality in the Circular Fashion Context

Brands Leading the Charge: Sustainability drives growth and profitability

While much work remains, pioneering brands are already demonstrating the commercial viability of circular models.

Exhibit 4: Brands globally showing how sustainability initaitives drives business growth

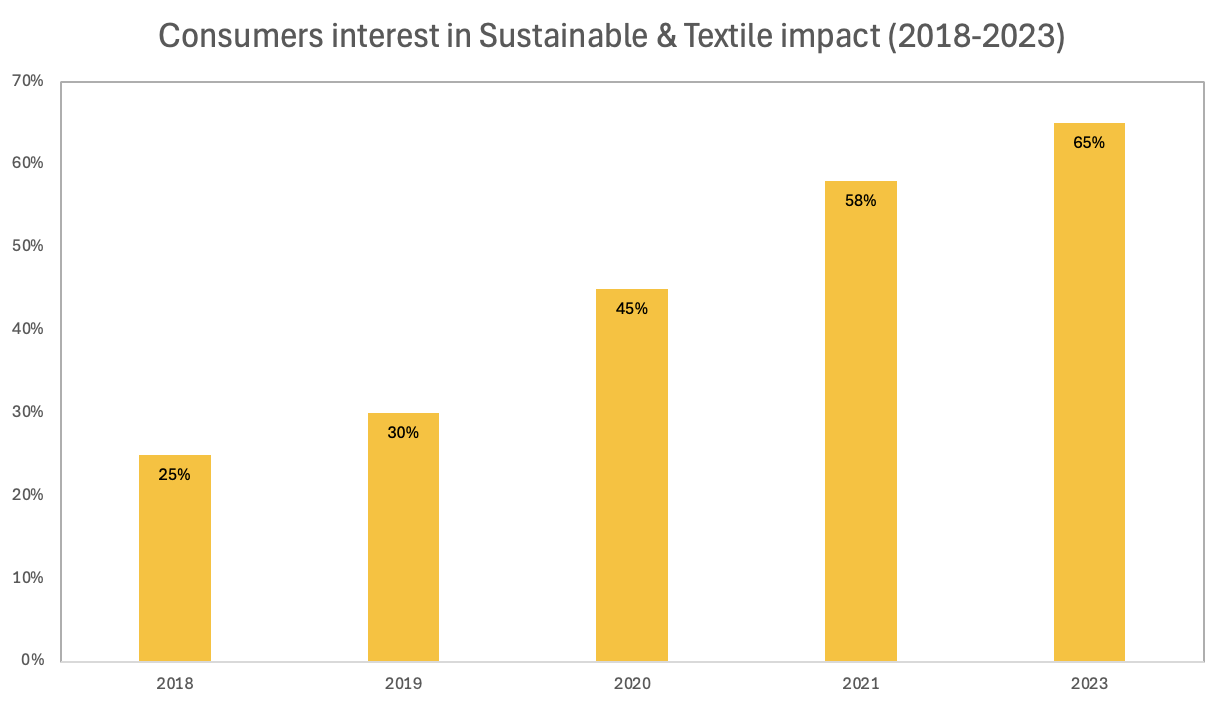

The Consumer Conundrum and Shifting Hearts and Wallets

Consumer sentiment is a critical driver. While awareness of fashion's impact is growing, the "intent-action gap" persists.

Exhibit 5: Key Consumer Barriers to Sustainable Fashion Adoption (2018-2023)

The shift needs to focus on making sustainable choices easier, more appealing, and economically viablefor the average consumer. Brands must:

Demystify Sustainability: Clear, verifiable information (e.g., via digital product passports) to combat "greenwashing."

Innovate for Affordability: Develop circular business models (rental, repair, subscription) that offer value without a prohibitive price tag.

Elevate Style & Quality: Prove that sustainable fashion is inherently stylish, durable, and aspirational.

Incentivize Return & Repair: Make it effortless for consumers to return items for recycling, repair, or resale (e.g., take-back schemes, easy repair services).

The Investment Opportunity: The time is now

The sustainable luxury shift is the primary growth driver for the entire sector, translating into massive capital opportunities globally.

Global and European Opportunity Summary

The shift to sustainable luxury is the highest-contributing driver of growth across the entire sector.

Exhibit 6: Consumer shows clear upward trajectory in market readiness and demand

Why invest now?

Regulatory Certainty: New policies provide a clear roadmap and competitive advantage for compliant businesses, mitigating future regulatory risk.

Untapped Value in Waste: The vast quantities of textile waste are no longer just trash; they are valuable feedstock.

Technological Breakthroughs: Advances in material science, automation, and digital tools are making circularity more feasible and cost-effective.

New Business Models: The rise of rental, resale, and repair creates diversified revenue streams and higher customer lifetime value.

Conclusion: Weaving a Resilient Future

The unravelling of the linear fashion model is in full swing, propelled by converging forces of bold new policy, technological leaps, and an increasingly aware consumer base. Sustainable fashion is transitioning from an aspirational ideal to a market necessity.

This is more than a responsibility; it is the single most exciting investment opportunity in the modern retail landscape. By committing capital to the infrastructure, materials science, and business models of the circular economy, investors and brands alike can weave a future that is not only environmentally sound but economically resilient and highly profitable. The window for early advantage is open—the time to act is now.

References:

1. Exhibit 2: European Parliament & Statista, October 2025

2. Exhibit 4: Brands websites

3. Exhibit 5: Adapted from various consumer surveys (McKinsey, Fashion Revolution)

4. Exhibit 6: GreenBiz/Crunchbase Data, 2023